Aerospace and defense company Howmet (NYSE: HWM) announced better-than-expected revenue in Q4 CY2024, with sales up 9.2% year on year to $1.89 billion. Guidance for next quarter’s revenue was better than expected at $1.94 billion at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.74 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Howmet? Find out by accessing our full research report, it’s free.

Howmet (HWM) Q4 CY2024 Highlights:

- Revenue: $1.89 billion vs analyst estimates of $1.88 billion (9.2% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.74 vs analyst estimates of $0.72 (2.8% beat)

- Adjusted EBITDA: $507 million vs analyst estimates of $494.8 million (26.8% margin, 2.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $8.03 billion at the midpoint, in line with analyst expectations and implying 8.1% growth (vs 11.9% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.17 at the midpoint, missing analyst estimates by 1.2%

- EBITDA guidance for the upcoming financial year 2025 is $2.13 billion at the midpoint, in line with analyst expectations

- Operating Margin: 23.5%, up from 18.8% in the same quarter last year

- Free Cash Flow Margin: 20%, down from 23.3% in the same quarter last year

- Market Capitalization: $52.04 billion

Howmet Aerospace Executive Chairman and Chief Executive Officer John Plant said, “Howmet drove a healthy set of results to close out the year, exceeding the high end of guidance. Revenue in the fourth quarter 2024 grew 9% year over year to a record $1.9 billion, with commercial aerospace growth of 13% supported by engine spares volumes. Adjusted EBITDA* grew 27% to $507 million and Adjusted EBITDA Margin* increased approximately 380 basis points to 26.8%, also records. Adjusted Earnings per Share* grew 40% to a record $0.74.”

Company Overview

Inventing the first forged aluminum truck wheel, Howmet (NYSE: HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

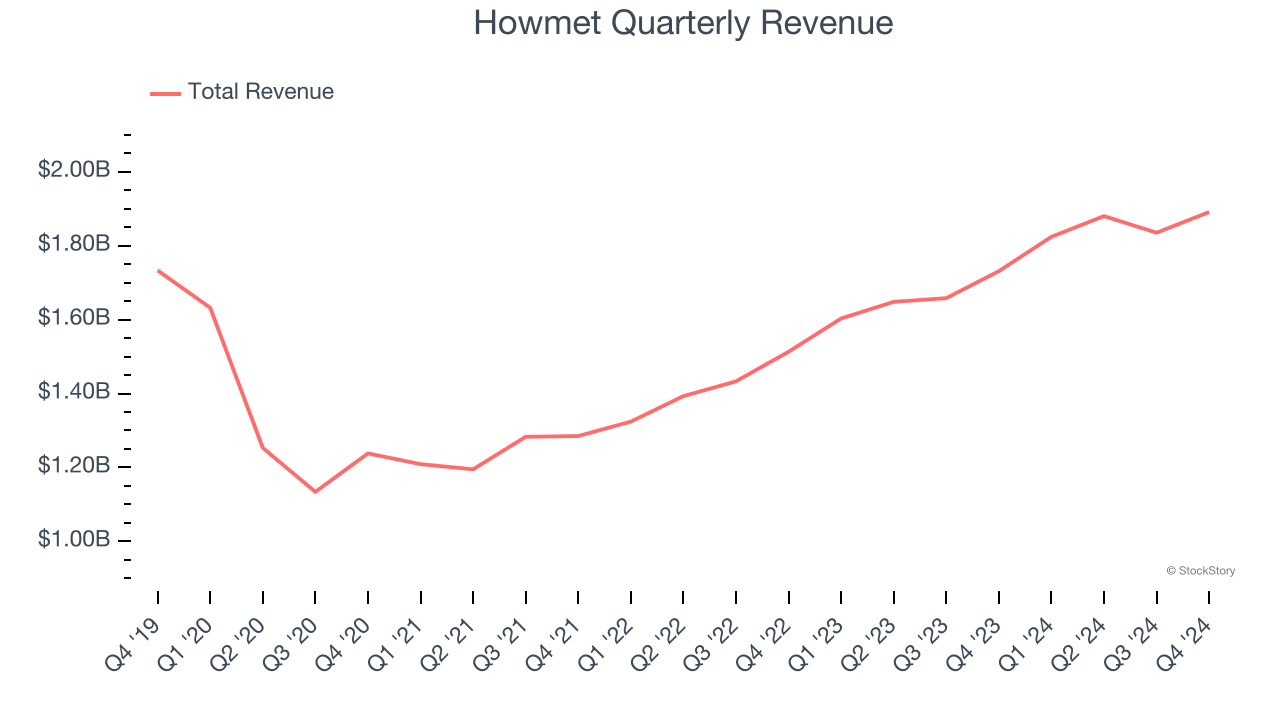

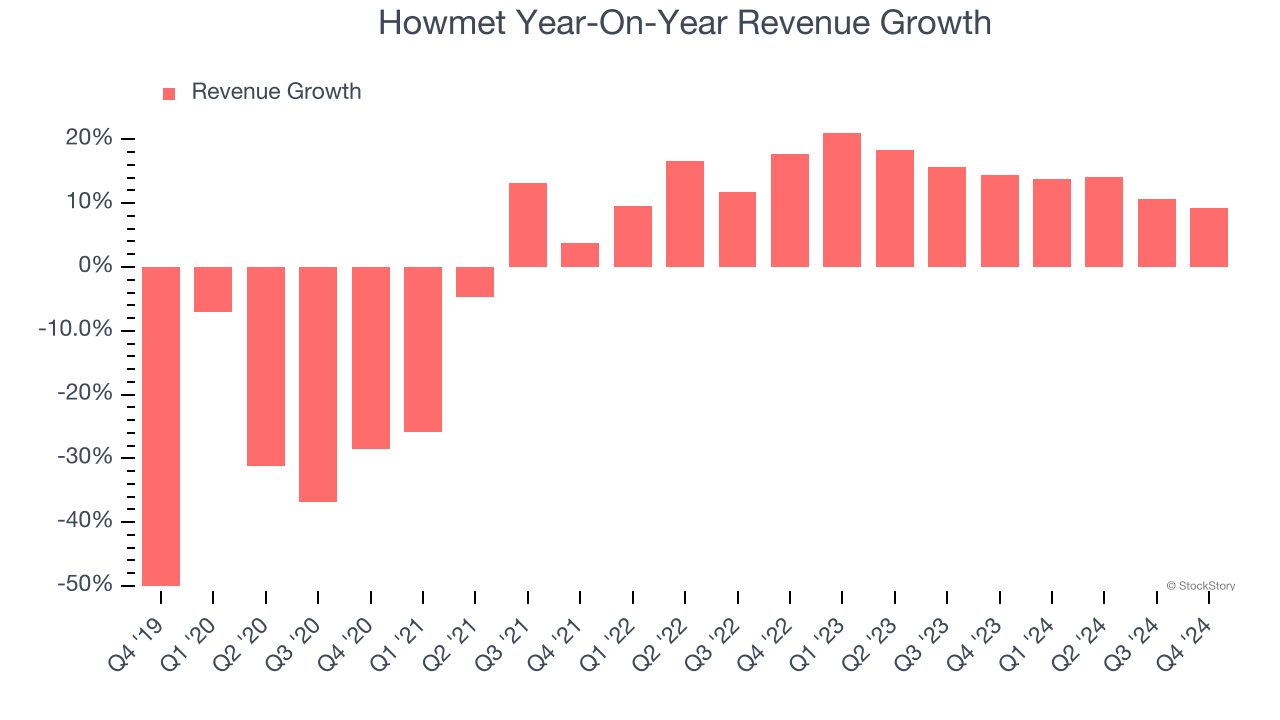

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Howmet struggled to consistently increase demand as its $7.43 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks, but there are still things to like about Howmet.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Howmet’s annualized revenue growth of 14.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Engine products and Fastening systems, which are 51.4% and 21.2% of revenue. Over the last two years, Howmet’s Engine products revenue (aircraft engines, industrial turbines) averaged 17.8% year-on-year growth while its Fastening systems revenue (connector products and tools) averaged 18.9% growth.

This quarter, Howmet reported year-on-year revenue growth of 9.2%, and its $1.89 billion of revenue exceeded Wall Street’s estimates by 0.7%. Company management is currently guiding for a 6.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and implies the market sees some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

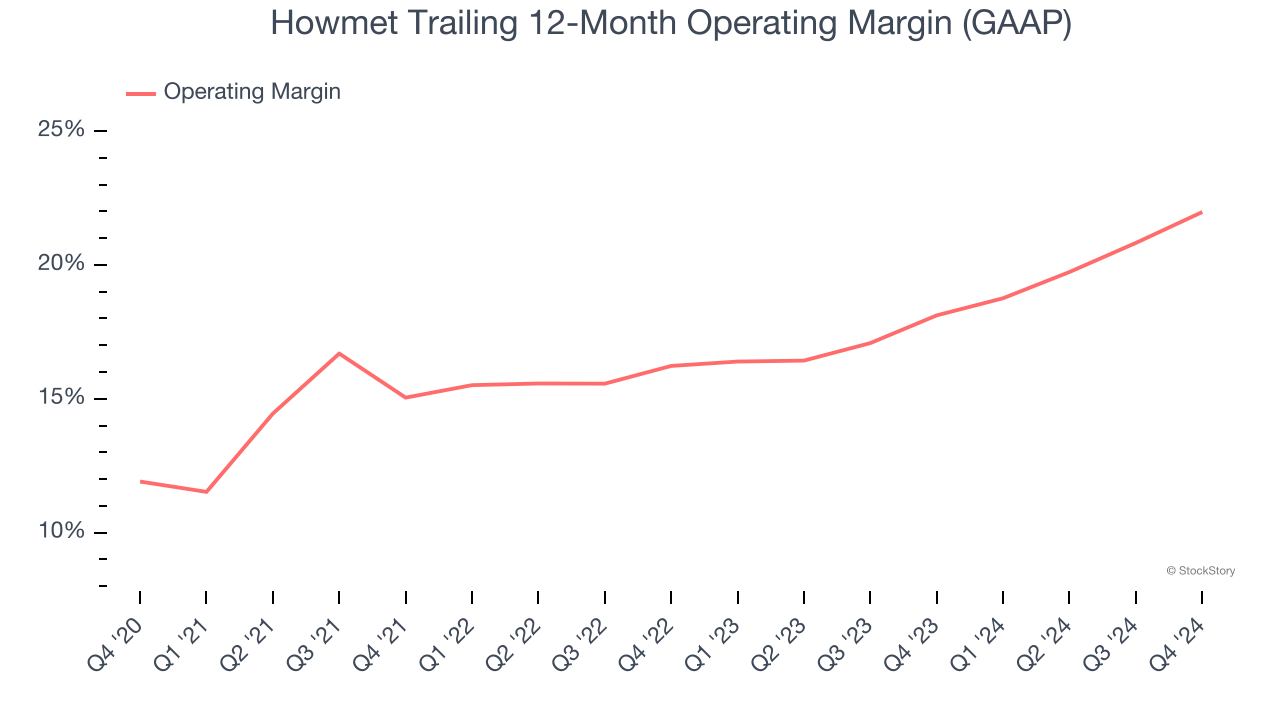

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Howmet has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.1%.

Looking at the trend in its profitability, Howmet’s operating margin rose by 10.1 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q4, Howmet generated an operating profit margin of 23.5%, up 4.7 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

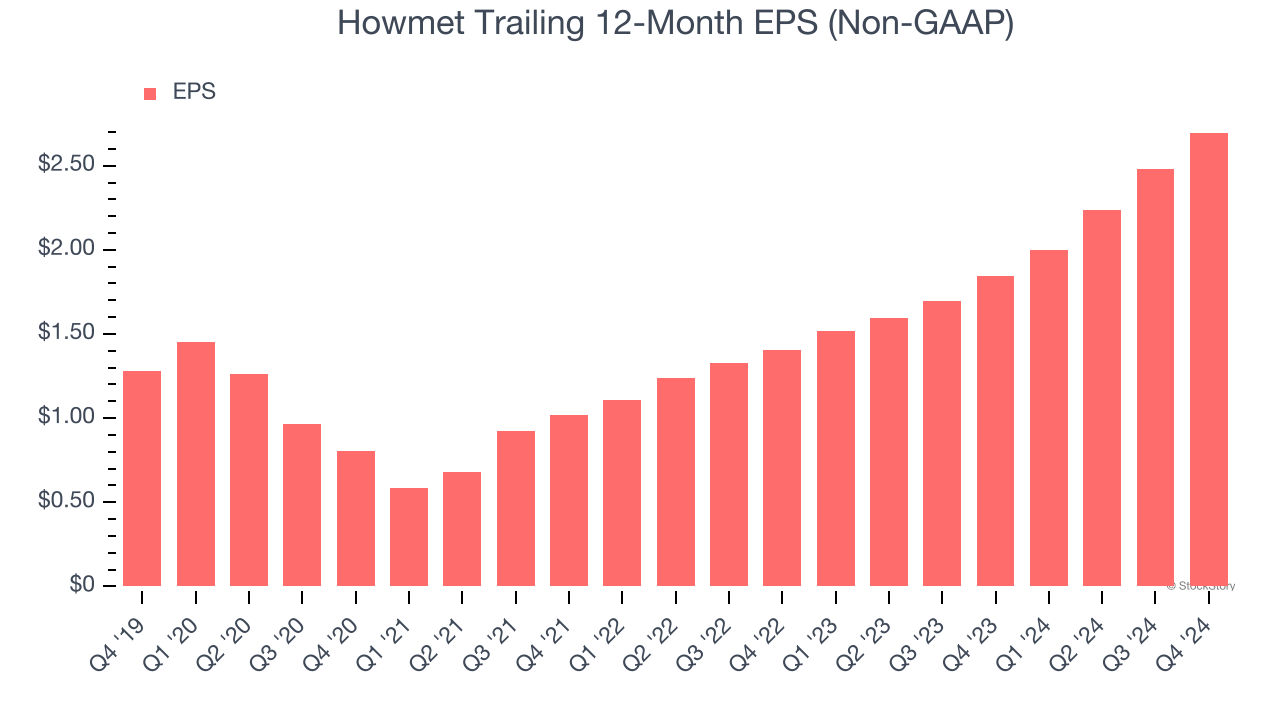

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Howmet’s EPS grew at a spectacular 16.1% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

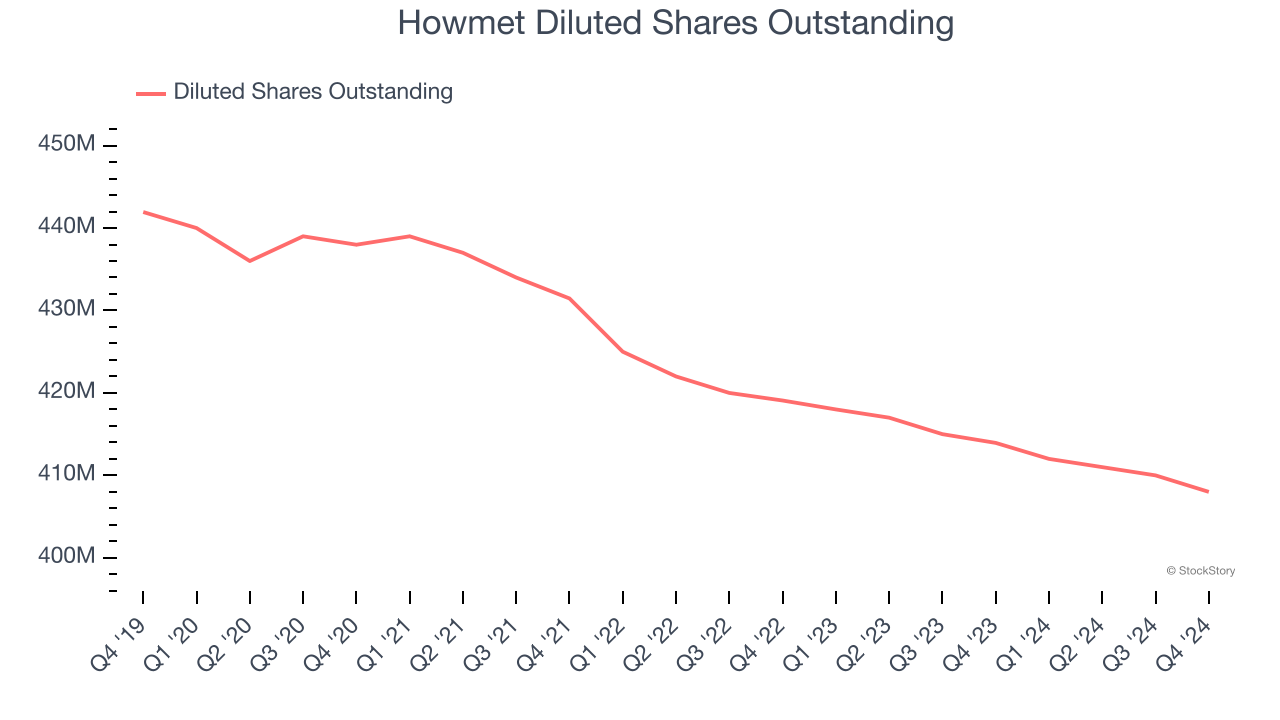

Diving into Howmet’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Howmet’s operating margin expanded by 10.1 percentage points over the last five years. On top of that, its share count shrank by 7.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Howmet, its two-year annual EPS growth of 38.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Howmet reported EPS at $0.74, up from $0.53 in the same quarter last year. This print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects Howmet’s full-year EPS of $2.70 to grow 18.4%.

Key Takeaways from Howmet’s Q4 Results

It was great to see Howmet’s EBITDA guidance for next quarter exceed analysts’ expectations. We were also glad its Engine products revenue topped Wall Street’s estimates. On the other hand, its full-year revenue and EBITDA guidance were just in line with Wall Street’s estimates. Zooming out, we think this was a solid quarter, although the guidance could have been better. The stock remained flat at $128.12 immediately after reporting.

So do we think Howmet is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.