Pet company Central Garden & Pet (NASDAQ: CENT) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 3.5% year on year to $656.4 million. Its GAAP profit of $0.21 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it’s free.

Central Garden & Pet (CENT) Q4 CY2024 Highlights:

- Revenue: $656.4 million vs analyst estimates of $628.7 million (3.5% year-on-year growth, 4.4% beat)

- EPS (GAAP): $0.21 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $55.44 million vs analyst estimates of $31.92 million (8.4% margin, 73.7% beat)

- Operating Margin: 4.3%, up from 1.3% in the same quarter last year

- Free Cash Flow was -$74.93 million compared to -$79.91 million in the same quarter last year

- Market Capitalization: $2.12 billion

“The fiscal year is off to a strong start, driven by increased first quarter shipments, productivity gains and easing inflation, all contributing to growth in both our top and bottom line,” said Niko Lahanas, CEO of Central Garden & Pet.

Company Overview

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ: CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $3.22 billion in revenue over the past 12 months, Central Garden & Pet carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

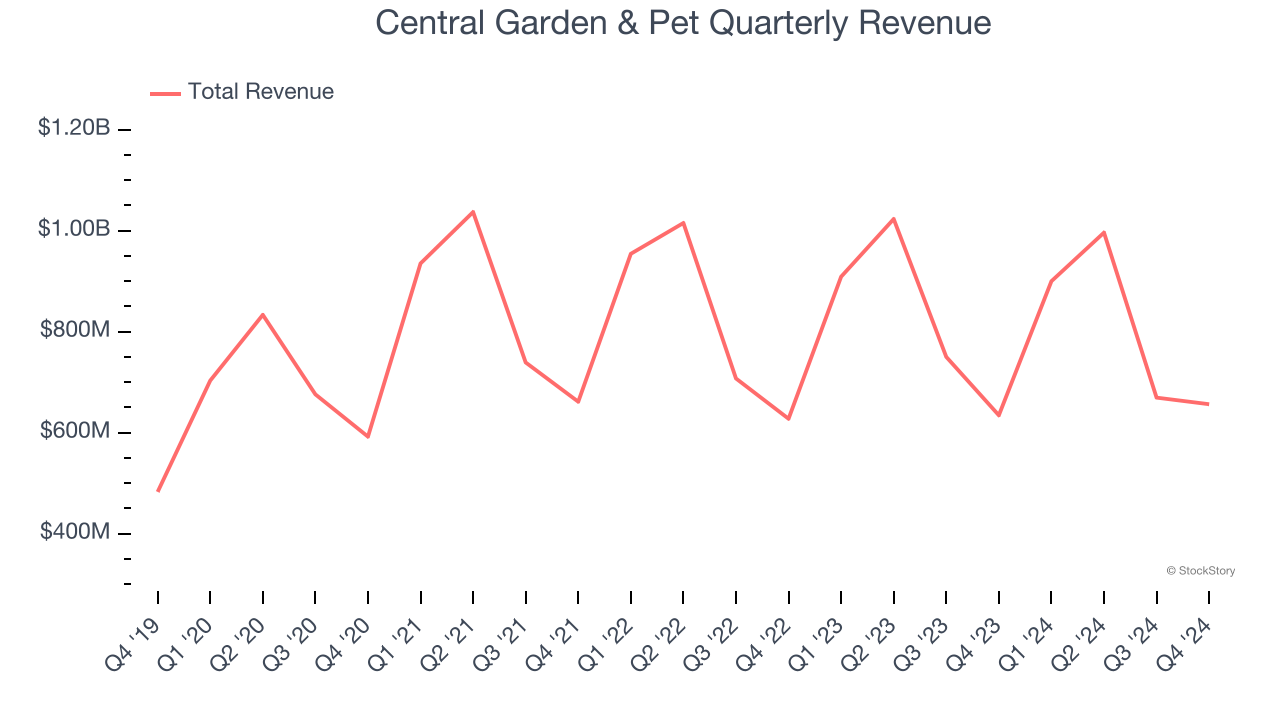

As you can see below, Central Garden & Pet’s demand was weak over the last three years. Its sales fell by 1.5% annually, showing demand was weak. This is a rough starting point for our analysis.

This quarter, Central Garden & Pet reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 4.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

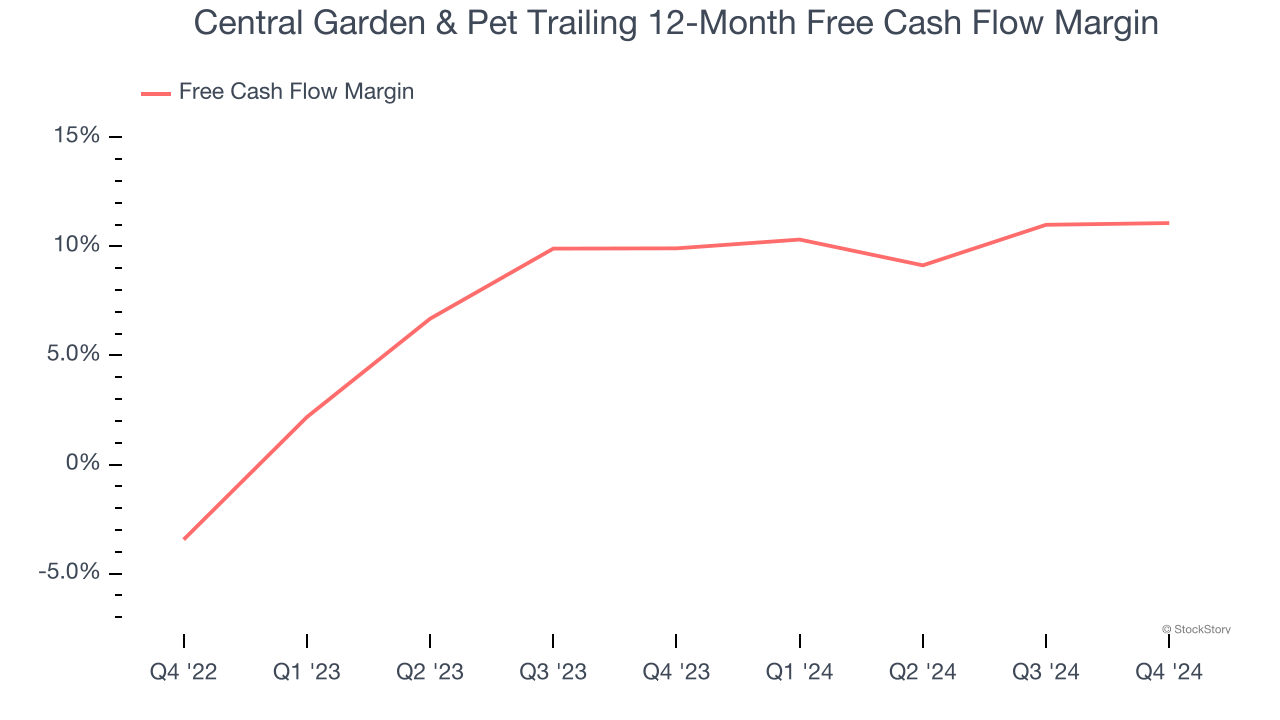

Central Garden & Pet has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.5% over the last two years, quite impressive for a consumer staples business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Central Garden & Pet’s margin expanded by 1.2 percentage points over the last year. This is encouraging because it gives the company more optionality.

Central Garden & Pet burned through $74.93 million of cash in Q4, equivalent to a negative 11.4% margin. The company’s cash burn was similar to its $79.91 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Central Garden & Pet’s Q4 Results

We were impressed by how significantly Central Garden & Pet blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a solid quarter. The stock traded up 2.2% to $37.90 immediately following the results.

Indeed, Central Garden & Pet had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.