Fast-food company Yum China (NYSE: YUMC) fell short of the market’s revenue expectations in Q4 CY2024 as sales rose 4.1% year on year to $2.60 billion. Its non-GAAP profit of $0.30 per share was in line with analysts’ consensus estimates.

Is now the time to buy Yum China? Find out by accessing our full research report, it’s free.

Yum China (YUMC) Q4 CY2024 Highlights:

- Revenue: $2.60 billion vs analyst estimates of $2.64 billion (4.1% year-on-year growth, 1.7% miss)

- Adjusted EPS: $0.30 vs analyst estimates of $0.29 (in line)

- Adjusted EBITDA: $292 million vs analyst estimates of $310.2 million (11.3% margin, 5.9% miss)

- Operating Margin: 5.8%, up from 4.4% in the same quarter last year

- Free Cash Flow was -$15 million compared to -$72 million in the same quarter last year

- Locations: 16,395 at quarter end, up from 14,644 in the same quarter last year

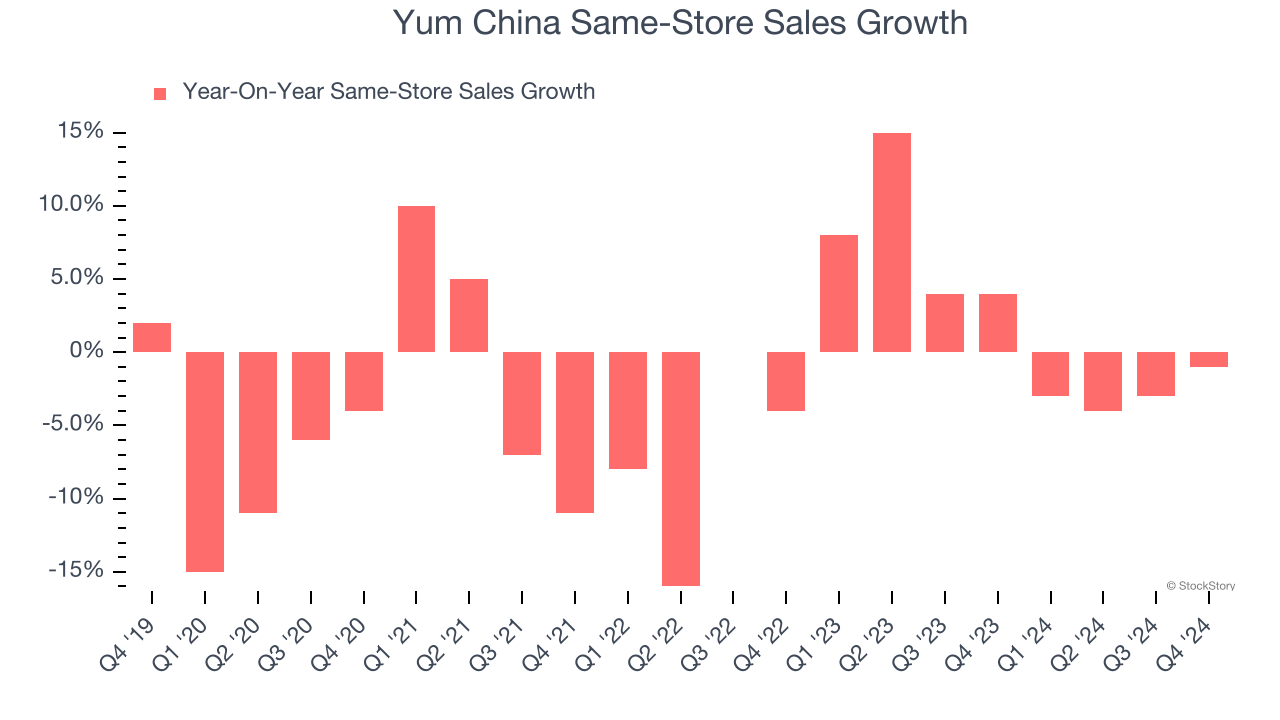

- Same-Store Sales fell 1% year on year (4% in the same quarter last year)

- Market Capitalization: $17.16 billion

Joey Wat, CEO of Yum China, commented, "We closed the year with a strong fourth quarter, propelling us to a number of record highs in 2024. In the fourth quarter, our system sales growth surpassed the restaurant industry's growth rate. Our same-store sales index improved sequentially to 99% of prior year levels, driven by the eighth consecutive quarter of same-store transaction growth. OP margin expanded by 140 basis points, and restaurant margin increased by 160 basis points, both on a year-over-year basis. We have steadily improved our metrics since the second quarter, with improvement in same-store sales index, margins, and operating profit growth each quarter. These results demonstrate the resilience of our business and the effectiveness of our strategy in improving sales and profitability amid challenging market conditions."

Company Overview

One of China’s largest restaurant companies, Yum China (NYSE: YUMC) is an independent entity spun off from Yum! Brands in 2016.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.3 billion in revenue over the past 12 months, Yum China is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because it's harder to find incremental growth when your existing restaurant banners have penetrated most of the market. To accelerate system-wide sales, Yum China must lean into newer chains.

As you can see below, Yum China’s 5.2% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Yum China’s revenue grew by 4.1% year on year to $2.60 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.4% over the next 12 months, an acceleration versus the last five years. This projection is above average for the sector and implies its newer menu offerings will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Yum China operated 16,395 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 12.4% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Yum China’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.5% per year. This performance gives it the confidence to meaningfully expand its restaurant base.

In the latest quarter, Yum China’s same-store sales fell by 1% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Yum China’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $45.96 immediately following the results.

Is Yum China an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.