Even during a down period for the markets, ANI Pharmaceuticals has gone against the grain, climbing to $68.06. Its shares have yielded a 16.1% return over the last six months, beating the S&P 500 by 23%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in ANI Pharmaceuticals, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re glad investors have benefited from the price increase, but we don't have much confidence in ANI Pharmaceuticals. Here are three reasons why you should be careful with ANIP and a stock we'd rather own.

Why Is ANI Pharmaceuticals Not Exciting?

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ: ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $614.4 million in revenue over the past 12 months, ANI Pharmaceuticals is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

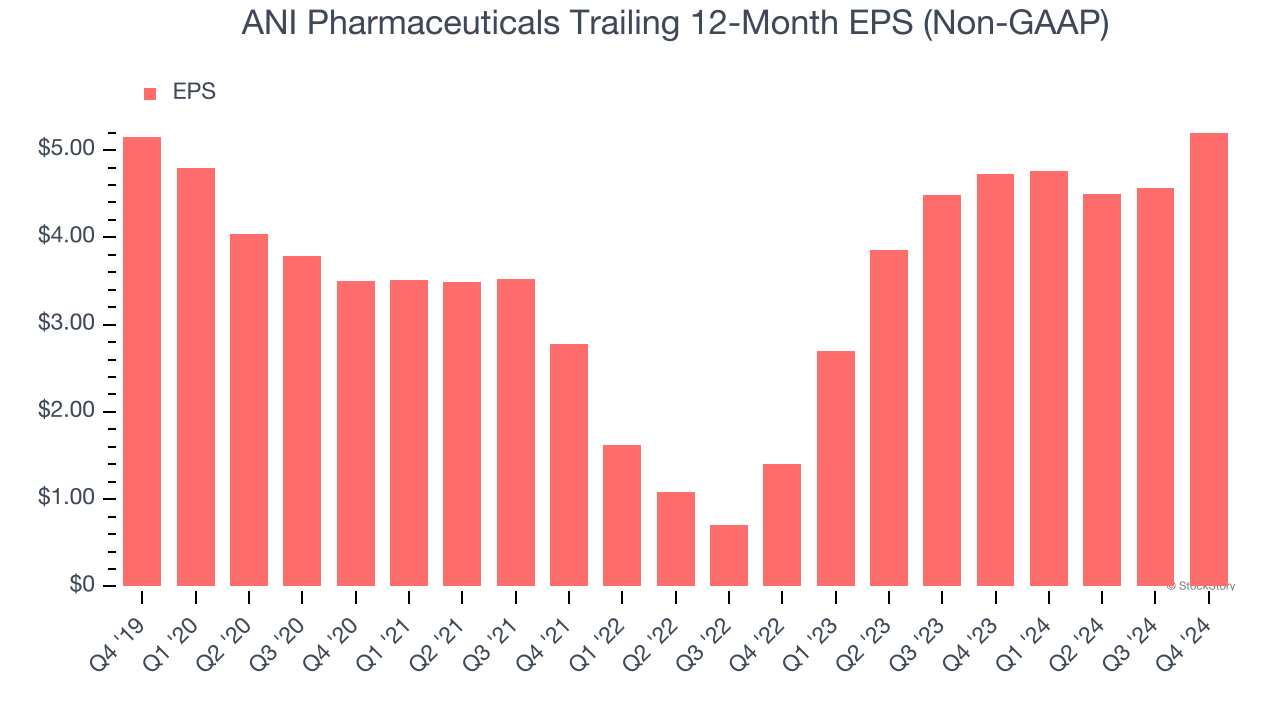

2. EPS Growth Has Stalled

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

ANI Pharmaceuticals’s flat EPS over the last five years was below its 24.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

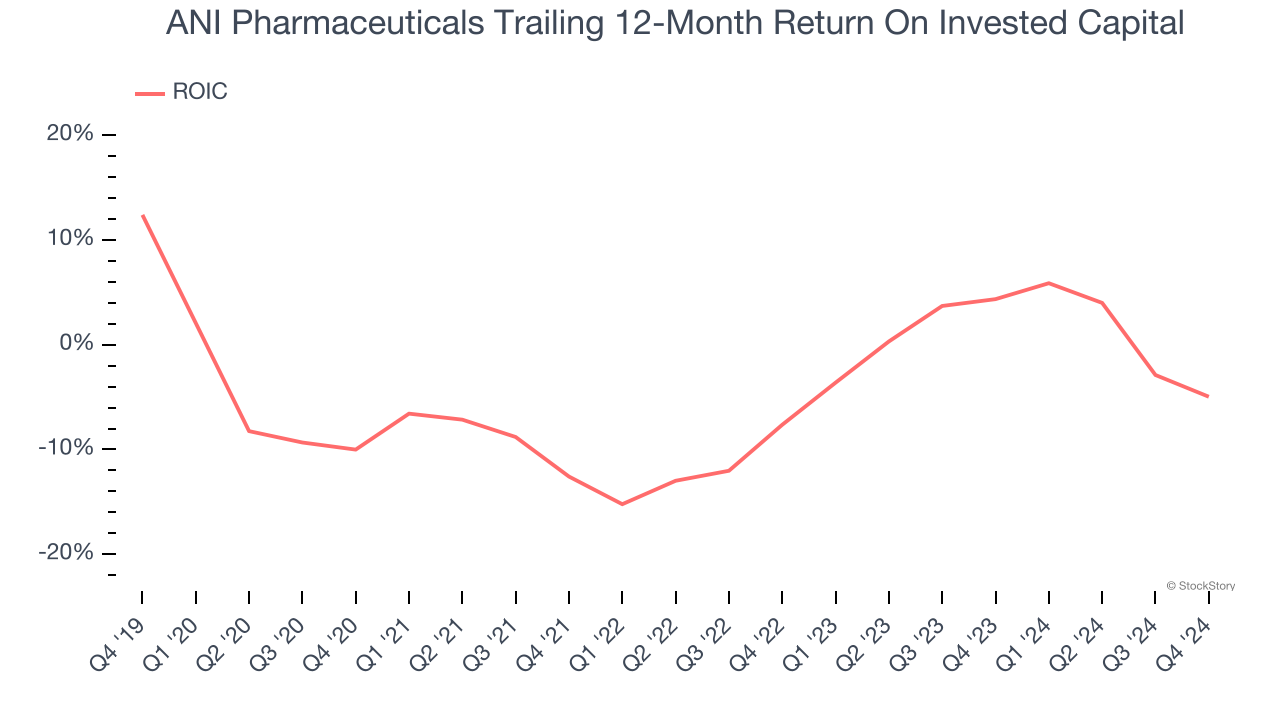

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

ANI Pharmaceuticals’s five-year average ROIC was negative 6.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

ANI Pharmaceuticals isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 13× forward price-to-earnings (or $68.06 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of ANI Pharmaceuticals

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.