Lowe's has gotten torched over the last six months - since October 2024, its stock price has dropped 20% to $225.44 per share. This might have investors contemplating their next move.

Is now the time to buy Lowe's, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why LOW doesn't excite us and a stock we'd rather own.

Why Is Lowe's Not Exciting?

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

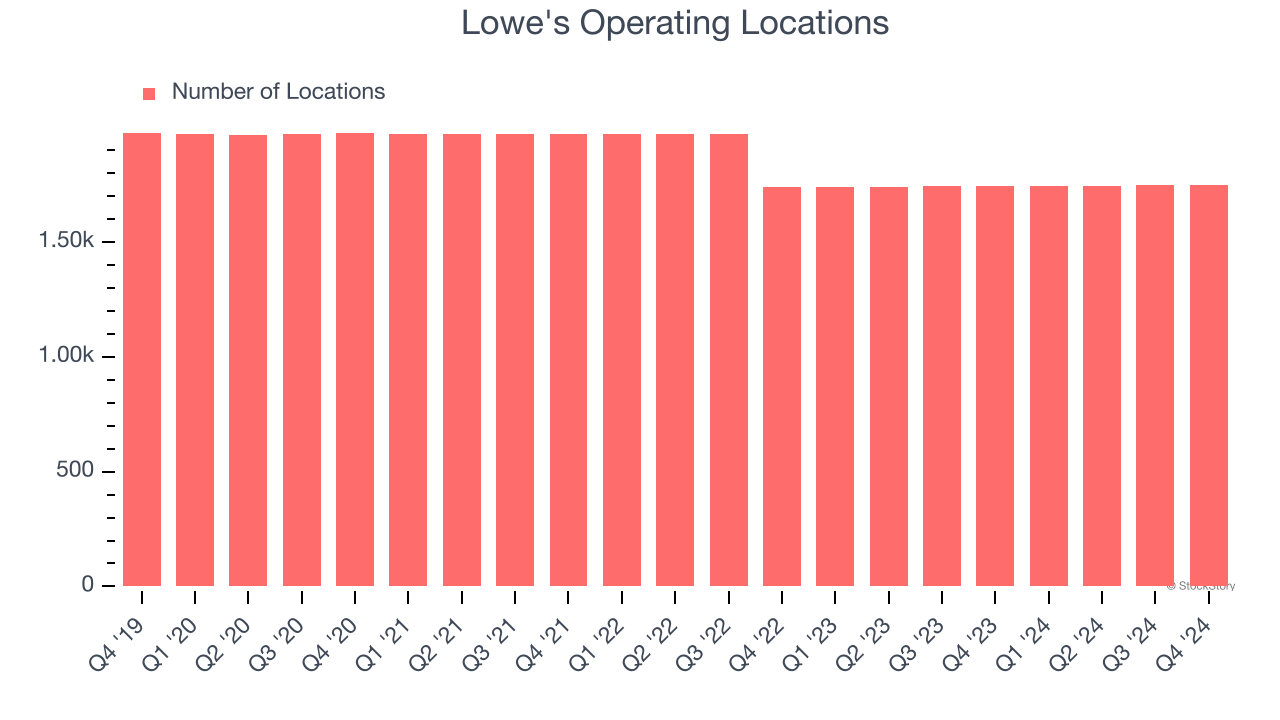

1. Stores Are Closing, a Headwind for Revenue

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Lowe's listed 1,748 locations in the latest quarter and has generally closed its stores over the last two years, averaging 4.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

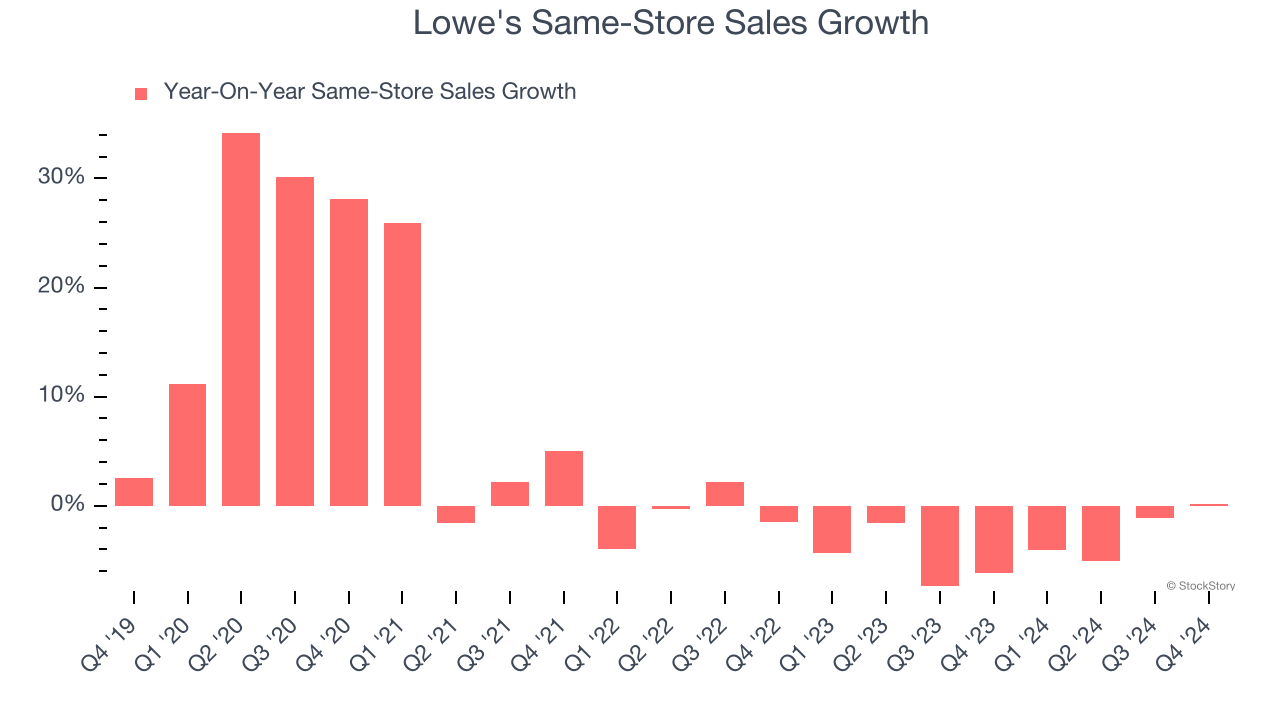

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 3.7% annual declines.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Lowe’s revenue to stall, a slight deceleration versus its 3% annualized growth for the past five years. This projection is underwhelming and suggests its products will face some demand challenges.

Final Judgment

Lowe's isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 18.1× forward price-to-earnings (or $225.44 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Lowe's

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.