As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the engineered components and systems industry, including Applied Industrial (NYSE: AIT) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 engineered components and systems stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 1.1% below.

Thankfully, share prices of the companies have been resilient as they are up 8.1% on average since the latest earnings results.

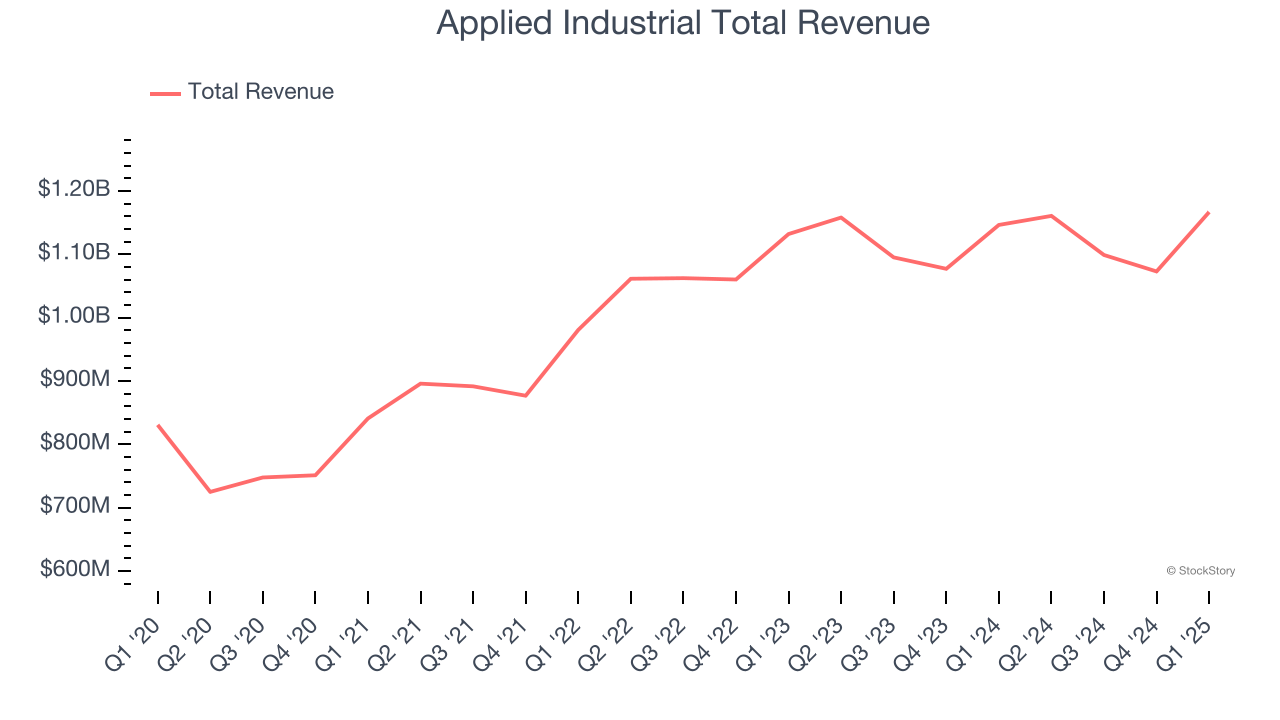

Applied Industrial (NYSE: AIT)

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE: AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

Applied Industrial reported revenues of $1.17 billion, up 1.8% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but full-year EPS guidance meeting analysts’ expectations.

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “We delivered another quarter of strong operational performance. EBITDA and EPS exceeded our expectations, increasing 7% and 4%, respectively, over the prior year on 2% sales growth. Our Applied team did an outstanding job managing through ongoing demand weakness and macro uncertainty with the average daily sales organic decline of 3% holding relatively steady with last quarter and within our guidance. In addition, gross margins and EBITDA margins expanded nicely, further reflecting internal initiatives, channel execution, mix tailwinds, and solid cost management. We also achieved record third quarter cash generation and increased our share repurchase activity. Lastly, I am pleased with the early progress of our recent acquisition of Hydradyne with integration ongoing and financial contribution expected to increase in coming quarters.”

Unsurprisingly, the stock is down 9.2% since reporting and currently trades at $220.38.

Is now the time to buy Applied Industrial? Access our full analysis of the earnings results here, it’s free.

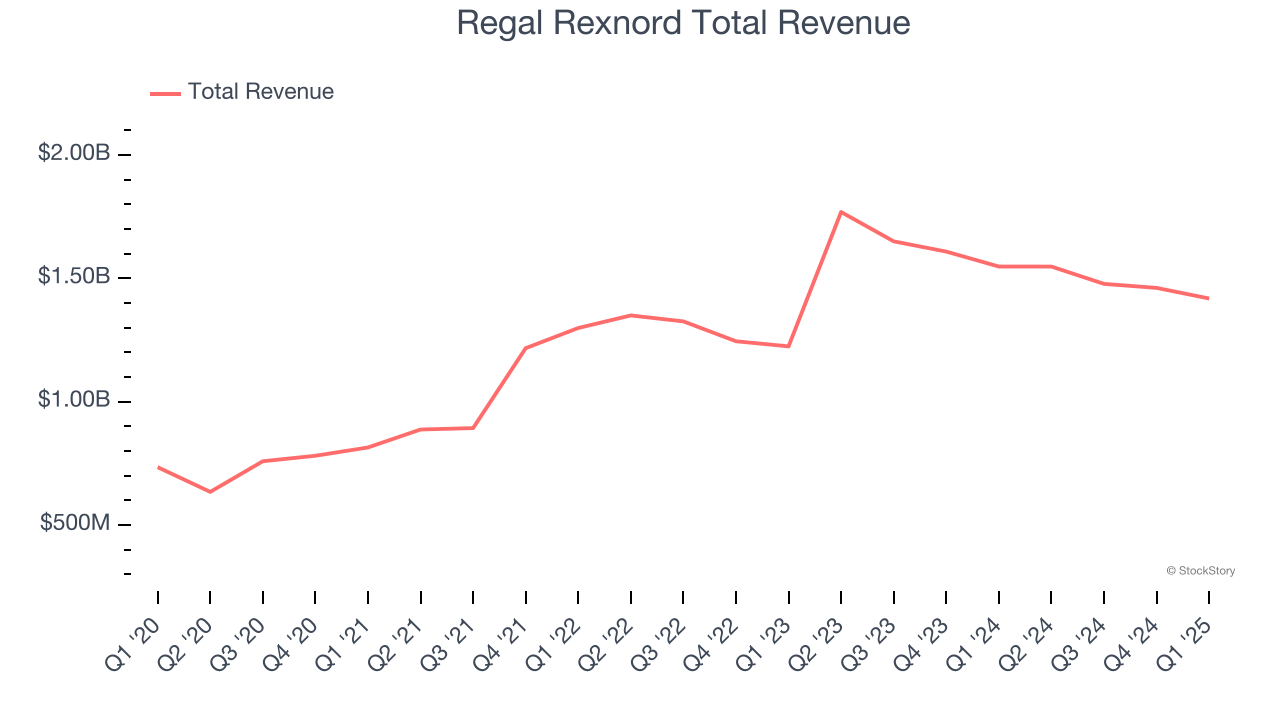

Best Q1: Regal Rexnord (NYSE: RRX)

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.42 billion, down 8.4% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue and EBITDA estimates.

The market seems happy with the results as the stock is up 22% since reporting. It currently trades at $134.38.

Is now the time to buy Regal Rexnord? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $405.4 million, down 2.9% year on year, falling short of analysts’ expectations by 4.7%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Park-Ohio delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.4% since the results and currently trades at $17.83.

Read our full analysis of Park-Ohio’s results here.

Enpro (NYSE: NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE: NPO) designs, manufactures, and sells products used for machinery in various industries.

Enpro reported revenues of $273.2 million, up 6.1% year on year. This number surpassed analysts’ expectations by 2.6%. Aside from that, it was a satisfactory quarter as it also produced a solid beat of analysts’ EBITDA estimates but full-year revenue guidance missing analysts’ expectations.

Enpro had the weakest full-year guidance update among its peers. The stock is up 13.1% since reporting and currently trades at $175.60.

Read our full, actionable report on Enpro here, it’s free.

Arrow Electronics (NYSE: ARW)

Founded as a single retail store, Arrow Electronics (NYSE: ARW) provides electronic components and enterprise computing solutions to businesses globally.

Arrow Electronics reported revenues of $6.81 billion, down 1.6% year on year. This print topped analysts’ expectations by 7.2%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Arrow Electronics achieved the biggest analyst estimates beat among its peers. The stock is up 5.4% since reporting and currently trades at $117.13.

Read our full, actionable report on Arrow Electronics here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.