Healthcare software provider Veeva Systems (NASDAQ: VEEV) announced better-than-expected revenue in Q1 CY2025, with sales up 16.7% year on year to $759 million. Guidance for next quarter’s revenue was optimistic at $767.5 million at the midpoint, 2.1% above analysts’ estimates. Its non-GAAP profit of $1.97 per share was 13% above analysts’ consensus estimates.

Is now the time to buy Veeva Systems? Find out by accessing our full research report, it’s free.

Veeva Systems (VEEV) Q1 CY2025 Highlights:

- Revenue: $759 million vs analyst estimates of $728.2 million (16.7% year-on-year growth, 4.2% beat)

- Adjusted EPS: $1.97 vs analyst estimates of $1.74 (13% beat)

- Adjusted Operating Income: $349.9 million vs analyst estimates of $308 million (46.1% margin, 13.6% beat)

- The company lifted its revenue guidance for the full year to $3.10 billion at the midpoint from $3.05 billion, a 1.6% increase

- Adjusted EPS guidance for the full year is $7.63 at the midpoint, beating analyst estimates by 4.6%

- Operating Margin: 30.8%, up from 23.9% in the same quarter last year

- Free Cash Flow Margin: 115%, up from 9% in the previous quarter

- Market Capitalization: $38.79 billion

Company Overview

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

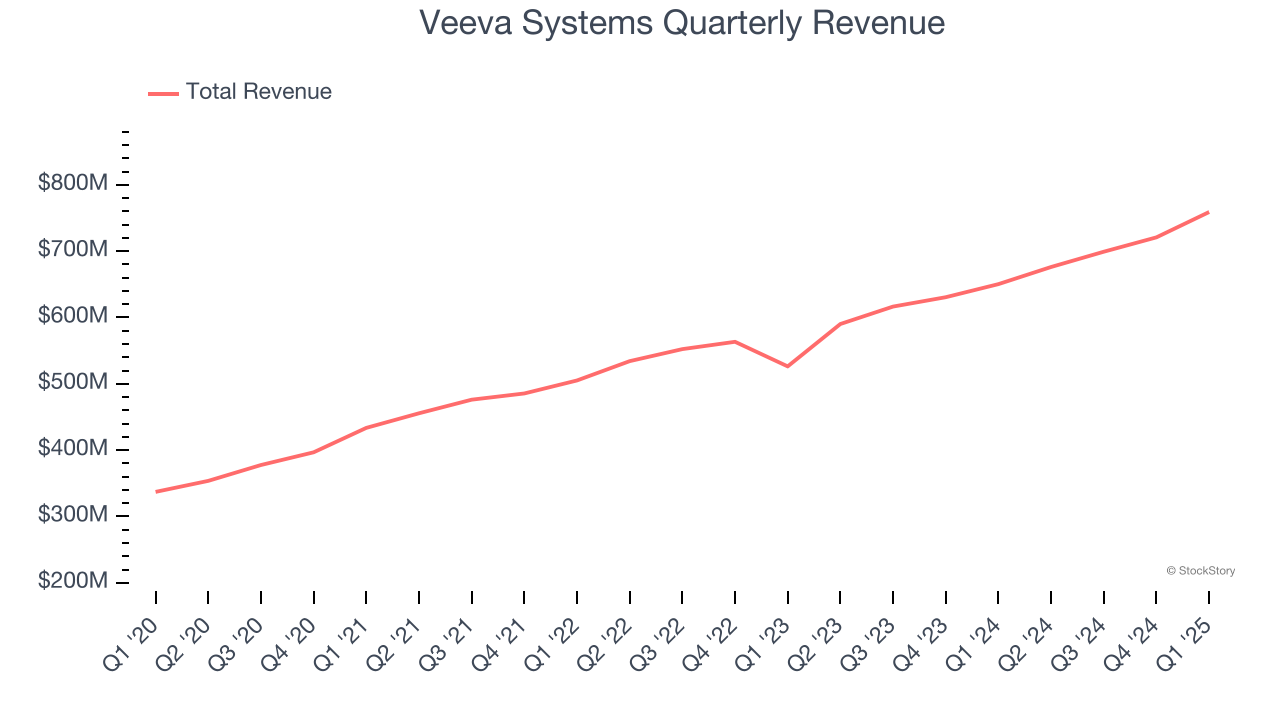

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Veeva Systems grew its sales at a 14.1% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Veeva Systems.

This quarter, Veeva Systems reported year-on-year revenue growth of 16.7%, and its $759 million of revenue exceeded Wall Street’s estimates by 4.2%. Company management is currently guiding for a 13.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

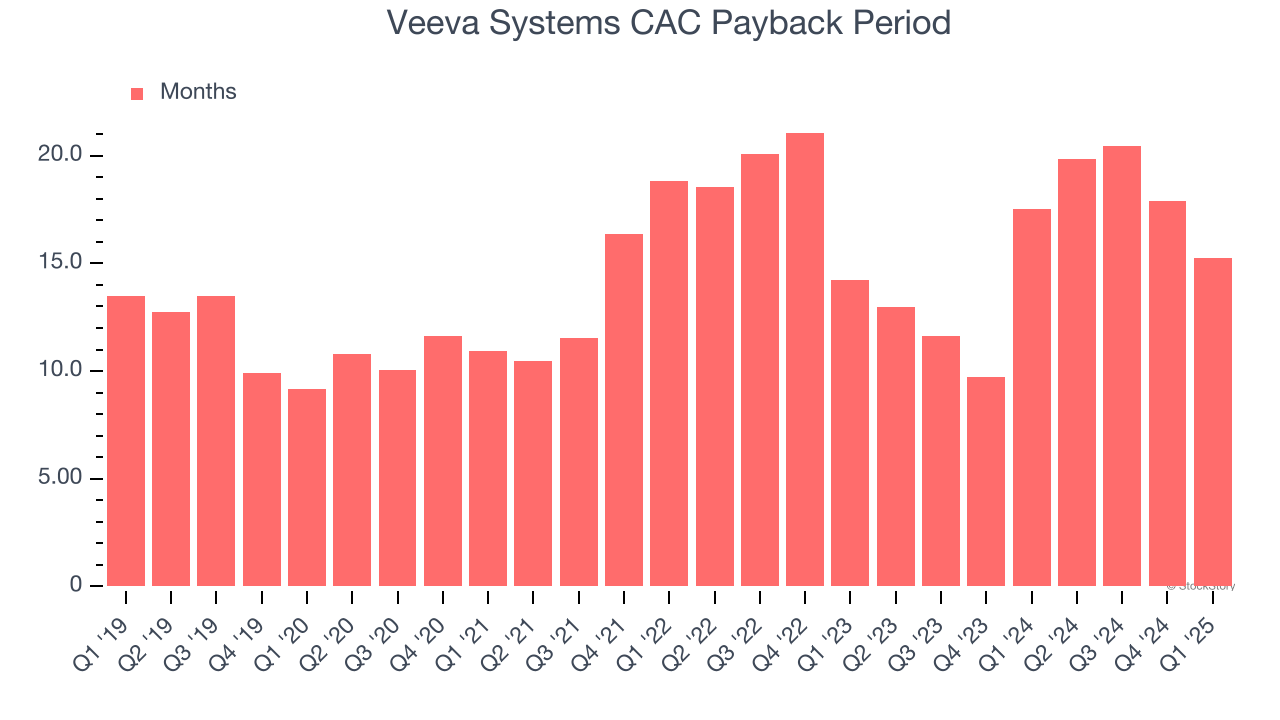

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Veeva Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Veeva Systems’s Q1 Results

This was a beat and raise quarter, with revenue and EPS exceeding estimates. Also, we were impressed by Veeva Systems’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 11.5% to $261.99 immediately following the results.

Sure, Veeva Systems had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.