Looking back on automation software stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Pegasystems (NASDAQ: PEGA) and its peers.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 9.1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

Slowest Q2: Pegasystems (NASDAQ: PEGA)

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ: PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

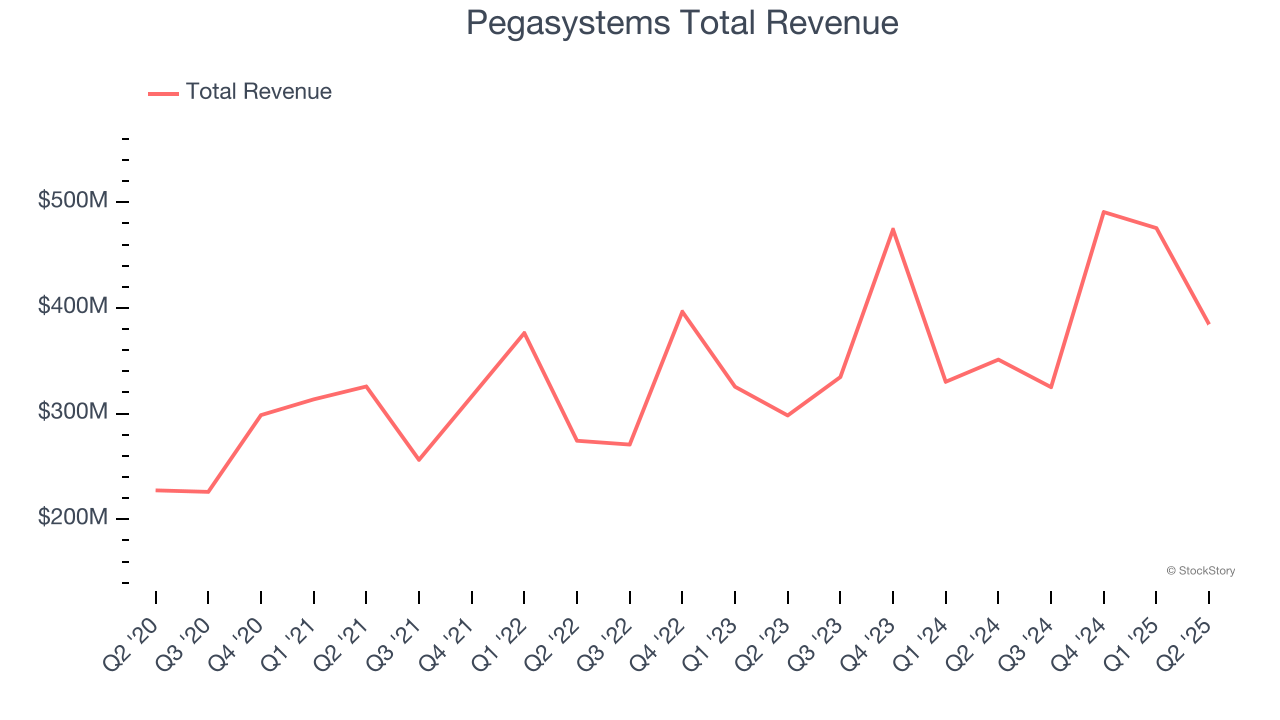

Pegasystems reported revenues of $384.5 million, up 9.5% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

“Our unique approach to AI was a key driver of our strong first half results,” said Alan Trefler, Pega founder and CEO.

Pegasystems delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 2.4% since reporting and currently trades at $52.17.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Best Q2: SoundHound AI (NASDAQ: SOUN)

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ: SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

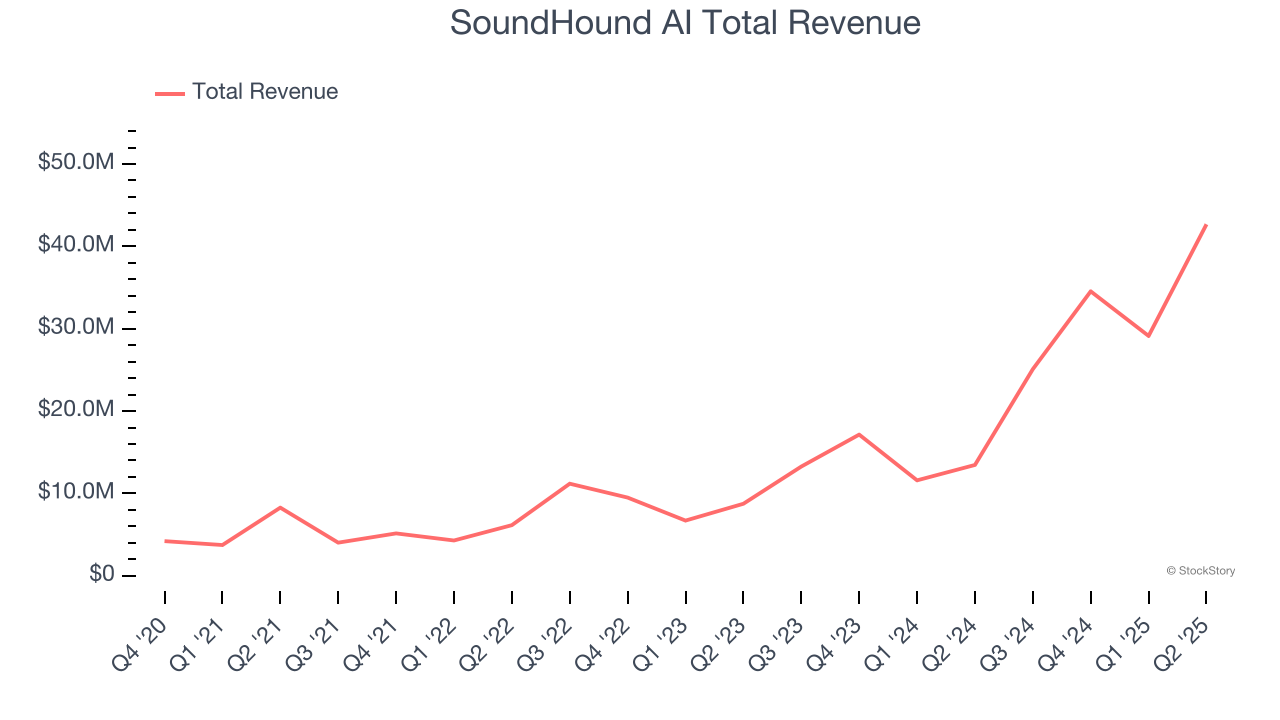

SoundHound AI reported revenues of $42.68 million, up 217% year on year, outperforming analysts’ expectations by 31.2%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

SoundHound AI pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.6% since reporting. It currently trades at $12.10.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Appian (NASDAQ: APPN)

Powering billions of transactions daily since its founding in 1999, Appian (NASDAQ: APPN) provides a low-code platform that helps businesses automate complex processes and operationalize artificial intelligence without extensive programming knowledge.

Appian reported revenues of $170.6 million, up 16.5% year on year, exceeding analysts’ expectations by 6.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 5.8% since the results and currently trades at $28.50.

Read our full analysis of Appian’s results here.

ServiceNow (NYSE: NOW)

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE: NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

ServiceNow reported revenues of $3.22 billion, up 22.4% year on year. This result topped analysts’ expectations by 2.9%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

ServiceNow had the weakest performance against analyst estimates among its peers. The stock is down 9.1% since reporting and currently trades at $868.80.

Read our full, actionable report on ServiceNow here, it’s free.

Microsoft (NASDAQ: MSFT)

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ: MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft reported revenues of $76.44 billion, up 18.1% year on year. This number beat analysts’ expectations by 3.5%. It was an exceptional quarter as it also produced a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat and an impressive beat of analysts’ operating income estimates.

The stock is down 2.1% since reporting and currently trades at $503.14.

Read our full, actionable report on Microsoft here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.