Teladoc’s stock price has taken a beating over the past six months, shedding 26.8% of its value and falling to $6.10 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Teladoc, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Teladoc Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons there are better opportunities than TDOC and a stock we'd rather own.

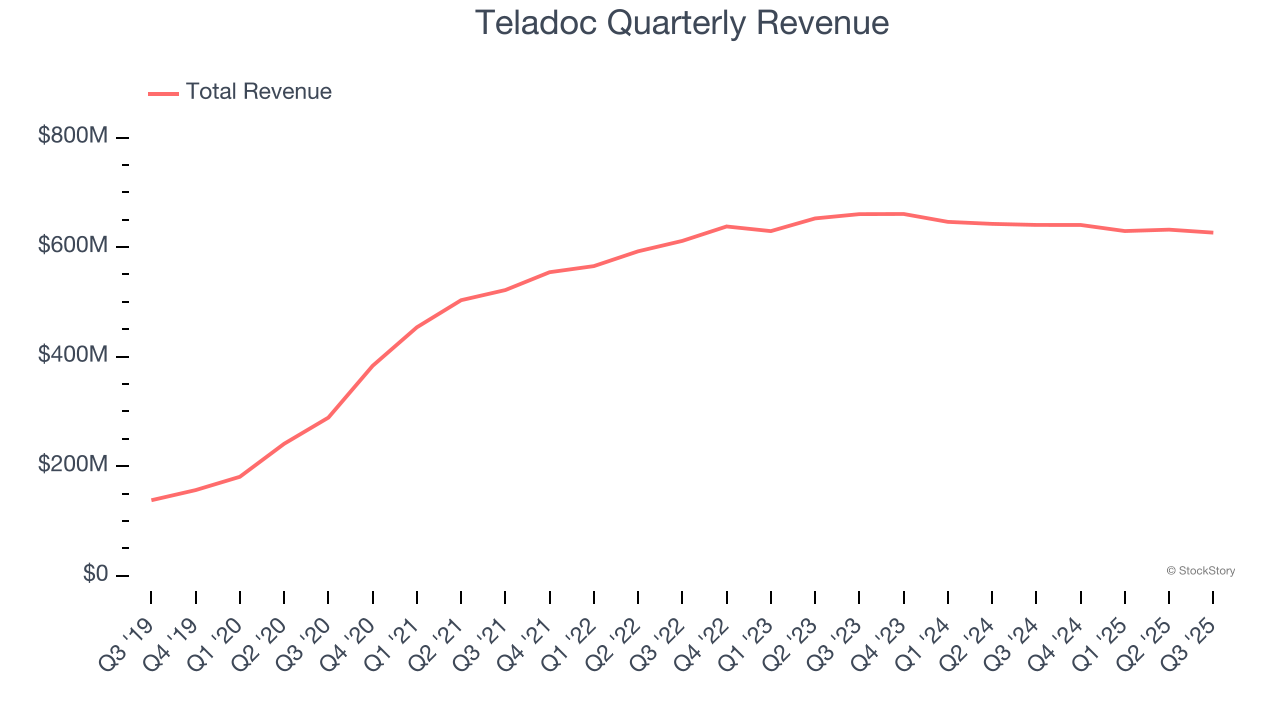

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Teladoc’s 2.9% annualized revenue growth over the last three years was sluggish. This fell short of our benchmarks.

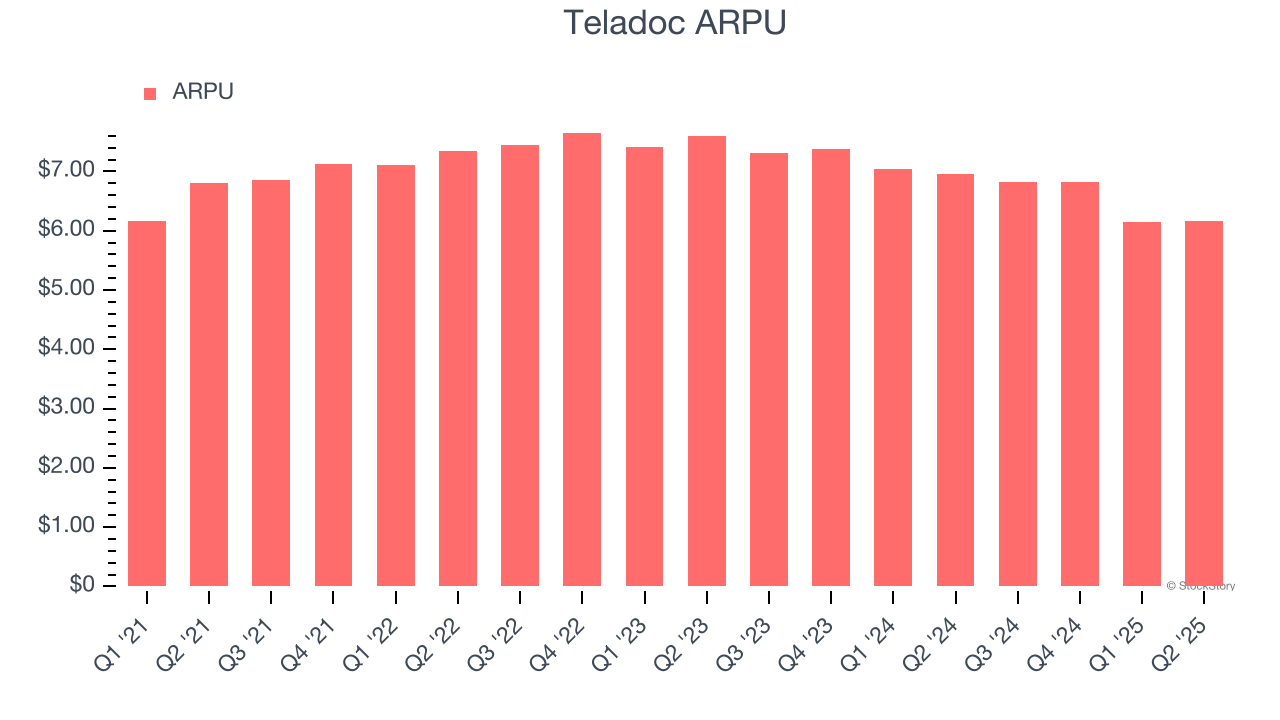

2. Customer Spending Decreases, Engagement Falling?

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Teladoc’s take rate, or "cut", on each order.

Teladoc’s ARPU fell over the last two years, averaging 7.9% annual declines. This raises questions about its ability to engage users and signals its platform’s value is eroding.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Teladoc’s revenue to stall, a slight deceleration versus This projection is underwhelming and indicates its products and services will see some demand headwinds.

Final Judgment

Teladoc isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 4.7× forward EV/EBITDA (or $6.10 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Teladoc

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.