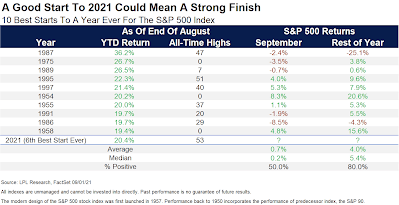

On the other hand, Ryan Detrick at LPL Financial documented the effects of strong price momentum on stock prices. History says that great starts to a year tend to see continued strength the final four months. “Looking at the previous top 10 starts to a year ever, the final four months have gained eight times,” explained LPL Financial Chief Market Strategist Ryan Detrick. “So should we see any seasonal weakness, we’d use it as an opportunity to buy before likely continued strength.”

In these circumstances, I am reminded of Bob Farrell's Rule 9, "When all the experts and forecasts agree – something else is going to happen." How should investors react? Turn cautious, or is this a contrarian opportunity to buy the dip?

The full post can be found here.